Data-Driven Pricing: Key Technologies, Business Practices, and Policy Implications

| Data-driven pricing: A set of practices that use personal and/or non-personal data to routinely inform decisions about the prices and products offered to consumers, often for the purpose of price personalization. |

State lawmakers in the U.S. are seeking to regulate various pricing strategies that fall under the umbrella of data-driven pricing, following the release in early 2025 of the Federal Trade Commission’s preliminary insights of a 6(b) study of what the Commission called “surveillance pricing.” Using a variety of terms—including “surveillance,” “algorithmic,” and “dynamic” pricing—legislators are targeting a range of data-driven pricing practices that often look different from one another, create different benefits for consumers and companies, and carry different risks. Distinguishing and disaggregating these pricing strategies will help policymakers, businesses, and consumers better understand how the relevant technologies and practices work, and better analyze the relevant benefits and risks. The chart below describes the major different data-driven pricing approaches.

| Pricing strategy | Description | Example |

| Reward or loyalty program | A company offers a discount, reward, or other incentive to repeat customers who sign up for the program. In return, the company receives additional customer data. | Discount programs that provide program members with lower prices on groceries as compared with non-members. |

| Dynamic pricing | Rapidly changing the price of a particular product or service based on real-time analysis of market conditions and consumer behavior. | Changing the price of a movie ticket, video streaming service, or taxi ride based on time of day, location, or demand at a specific point in time. |

| Consumer segmentation or profiling | A profile is created for a customer based on their personal data, including behavior and/or characteristics, and they are placed within a particular audience segment. Based on the profile or segment, they receive particular advertisements, prices, or promotions. | A coupon for diapers is advertised to a customer based on their inclusion in the marketing category “new parents,” which is based on their previous purchase history and age. |

| Search or product ranking | Altering the order in which search results or products appear, to give more prominence to certain results, based on general consumer data or specific customer behavioral data. This could potentially include changing the prominence of given products based on their price. | Placing more (or less) expensive items at the top of a retail website’s search results based on a consumer’s previous purchases. Alternatively, placing items that a customer has previously purchased at the top of a results page. |

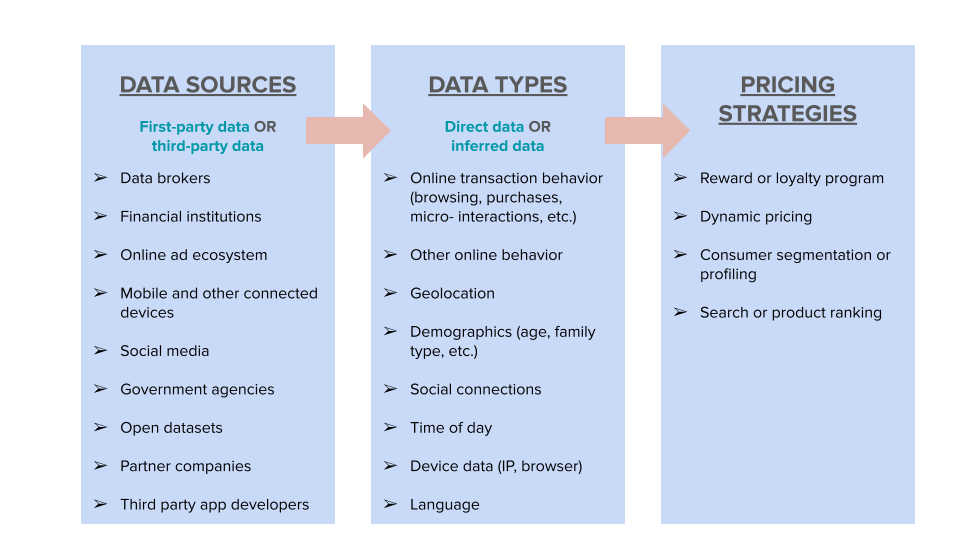

Companies that institute data-driven pricing can pull from either first-party or third-party data to inform pricing, covering a range of potential data types. As illustrated below, depending on what factors the company wants to consider in setting prices, the data they choose to use can come from a variety of sources, and can include personal or non-personal data. Increasingly, companies prefer to use first-party data, as they can be more confident of its quality and source, as well as their ability to handle it in ways that comply with privacy and data protection laws. However, many companies also use data collected from co-branded relationships (eg, credit card providers and airlines), or obtained from other entities (eg, data brokers). In this way, data-driven pricing is enabled by an ecosystem of entities that collect and share data, algorithms that make inferences and predictions about consumers, and physical and digital infrastructure that allow for price targeting and adjustment.

Note: This graphic is not exhaustive.

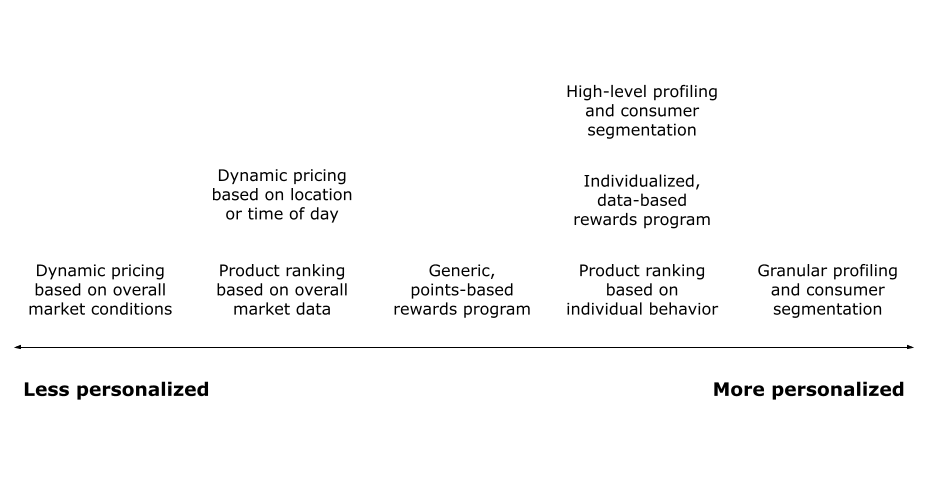

An important throughline across different data-driven pricing strategies is the level of personalization involved, or how tailored pricing is to a given individual. Personalization can vary not only across pricing strategies but even within them as well, depending on a company’s specific approach. For example, while loyalty programs tend to be relatively generic or non-individualized in the rewards they provide to members, they could also theoretically be more granular or targeted based on data the member provides to the company. Conversely, while consumer segmentation and profiling tend to be more personalized to individuals, they could also theoretically be based on broad, less-invasive categories of data.

| Algorithmic pricing In many cases, though not all, data-driven pricing strategies rely on algorithms that generate a given price based on analysis of input data, a practice known as “algorithmic pricing.” Depending on the jurisdiction, some practices may be subject to AI regulations, separate from emerging “algorithmic pricing” laws, and developers and/or deployers may have some legal obligations regarding the creation and/or use of these tools. Regardless of legal duties, companies will want to ensure that the use of any algorithmic pricing tools are considered within their general AI governance strategy. |

Depending on one’s definition, a range of strategies can fall within the category of data-driven pricing, and the relevant policy questions vary depending on the specific pricing strategy a company pursues and the context in which they implement it. Lawmakers have taken a range of different approaches to defining practices that fall under the umbrella of data-driven pricing and proposing rules governing these practices. Generally speaking, the major elements of data-driven pricing strategies that companies, lawmakers, and consumers should consider include:

- Personalization: As mentioned above, pricing can be based on either non-personal or personal data, and the personal data can vary in its sensitivity and granularity. Generally speaking, the more personalized a particular pricing strategy is, the more helpful it could potentially be for both consumers and company—but also potentially, if done without safeguards, the more invasive or discriminatory (see below). For example, a company could use data about a customer’s health status—either directly collected or inferred—to set a higher price for a particular product or service, knowing the customer is more willing to pay for a product that’s a necessity.

- Transparency: When consumers understand how pricing decisions are made, they are more likely to trust the company (and even when they do, they may still be skeptical of certain data-driven pricing practices). At the same time, providing complete transparency about data-driven pricing strategies may not be feasible. A New York law that went into effect July 8, 2025 requires entities using “personalized algorithmic pricing” to provide notice to consumers that the price was set by an algorithm using their personal data, but not which data or how this data impacted the price.

- Consumer control: In many cases, consumers actively want to enroll in reward or loyalty programs that exchange their personal data for lower prices, coupons, or other material benefits. These arrangements provide consumers with the ability to control whether they participate in a data-driven pricing strategy that incorporates their personal data.

- Discrimination: Data-driven pricing inherently involves different customers paying different amounts for similar products or services. Even the common practice of sending certain customers coupons means that other customers will be paying relatively more. When this price differential becomes a problem is up for debate, with some bright lines around certain practices that are patently illegal and unfair (eg, charging different prices for the same product based on race or another legally protected characteristic). Additionally, most states have enacted laws prohibiting price gouging, or charging extremely high prices, for certain necessary products during emergencies or other times when demand far outpaces supply.

- Personal data sharing: Data-driven pricing involves an ecosystem of actors who share data with one another, which could potentially increase the risk of personal data misuse or breach. Certain privacy-enhancing technologies (PETs) like data clean rooms and confidential computing, however, may allow entities to process one another’ s data securely for certain purposes without directly sharing it. Notably, these protections do not address the most common concerns stakeholders raise about data-driven pricing.

- Markets and competition: At a macro level, there is currently a dearth of research about the overall market impacts of data-driven pricing. While many strategies may improve market efficiency and lower prices for consumers, there is also concern that some strategies may result in collusive pricing, particularly if companies rely on the same algorithm to set prices. The aggregation of granular, personal consumer data may also create information asymmetries between sellers and buyers, disempowering consumers within the market.

For any questions, please contact Jameson Spivack, Deputy Director for U.S. Policy