What the Biden Executive Order on Digital Assets Means for Privacy

Author: Dale Rappaneau

Dale Rappaneau is a policy intern at the Future of Privacy Forum and a 3L at the University of Maine School of Law.

On March 9, the Biden Administration issued an Executive Order on “Ensuring Responsible Developments of Digital Assets” (“the Order”), published together with an explanatory Fact Sheet. The Order states that the growing adoption of digital assets throughout the economy and inconsistent controls to mitigate their risks necessitates a new governmental approach to regulating digital assets.

The Order outlines a whole-of-government approach to address a wide range of technological frameworks, including blockchain protocols and centralized systems. The Order frames this approach as an important step toward safeguarding consumers and businesses from illicit activities and potential privacy harms involving digital assets. In particular, it calls for a list of federal agencies and regulators to assess digital assets, consider future action, and ultimately provide reports recommending how to achieve the Order’s numerous policy goals. The Order recognizes the importance of incorporating data and privacy protections into this approach, which indicates that the Administration is actively considering the privacy risks associated with digital assets.

1. Covered Technologies

Definitions

Digital Assets – The Order defines digital assets broadly, including cryptocurrencies, stablecoins, and all central bank digital currencies (CBDCs), regardless of the technology used. The term also refers to any other representations of value or financial instrument issued or represented in a digital form through the use of distributed ledger technology relying on cryptography, such as a blockchain protocol.

CBDC – The Order defines a Central Bank Digital Currency (“CBDC”) as digital money that is a direct liability of the central bank, not of a commercial bank. This definition aligns with the recent Federal Reserve Board CBDC report. A U.S. CBDC could support a faster and more modernized financial system, but it would also raise important policy questions including how it would affect the current rules and regulations of the U.S. financial sector.

Cryptocurrencies – These are digital assets that may operate as a medium of exchange and are recorded through distributed ledger technologies that rely on cryptography. This definition is notable because blockchain is often mistaken as the only form of distributed ledger technology, leading some to believe that all cryptocurrencies require a blockchain. However, the Order defines cryptocurrencies by reference to distributed ledger technology – not blockchain – and seems to cover both mainstream cryptocurrencies utilizing a blockchain (e.g., bitcoin or Ether) and alternative cryptocurrencies built on distributed ledger technology without a blockchain (e.g., IOTA).

Stablecoins – The Order recognizes stablecoins as a category of cryptocurrencies featuring mechanisms aimed at maintaining a stable value. As reported by relevant agencies, stablecoin arrangements may utilize distributed or centralized ledger technology.

Implications of Covered Technologies

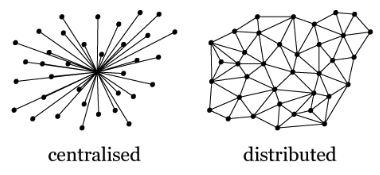

From a technical perspective, distributed ledger technologies such as blockchain stand in stark contrast to centralized systems. Blockchain protocols, for example, allow users to conduct financial transactions on a peer-to-peer level, without requiring oversight from the private sector or government. Centralized ledger technology, as used by most credit cards and banks, typically requires a private sector or government actor to facilitate financial transactions. In this environment, the data flows through the actor, who carries obligations to monitor and protect the data.

Despite the technical differences between these approaches, the Order appears to group these very different financial transaction systems into the single umbrella term of digital assets. It does this by including within the scope of the definition of digital assets all CBDCs, even ones utilizing centralized ledger technology, and other assets using distributed ledger technology. This homogenization of technological concepts may indicate that the Administration is seeking a uniform regulatory approach to these technologies.

2. Privacy Considerations of the EO

Section 2 of the Order states the principal policy objectives with respect to digital assets, which include: exploring a U.S. CBDC; ensuring responsible development and use of digital assets and their underlying ledger technologies; and mitigating finance and national security risks posed by the illicit use of digital assets.

Notably, the Administration uses the word “privacy” five times in this section, declaring that digital assets should maintain privacy, shield against arbitrary or unlawful surveillance, and incorporate privacy protections into their architecture. The need to ensure that digital assets preserve privacy raises notable, albeit different, implications for both centralized and decentralized technologies.

Privacy Implications of a United States CBDC

The Order places the highest urgency on developing and deploying a U.S. CBDC, which must be designed to include privacy protections. The Order states that a United States CBDC would be the liability of the Federal Reserve, which is currently experimenting with a number of CBDC system designs, including centralized and decentralized ledger technologies, as well as alternative technologies. Although the Federal Reserve has not chosen a particular system, the monetary authority has listed numerous privacy-related characteristics that should be incorporated into a United States CBDC regardless of the technology used.

First, the Federal Reserve recognizes that a CBDC would generate data about users’ financial transactions in the same ways that commercial banks and nonbanks do today. This may include a user’s name, email address, physical address, know-your-customer (KYC) data, and more. Depending on the design chosen for the CBDC, this data may be centralized under the control of a single entity or distributed across ledgers held by multiple entities or users.

Second, because of the robust rules designed to combat money laundering and financing of terrorism, a CBDC would need to allow intermediaries to verify the identity of the person accessing CBDC, just as banks and financial institutions currently do so. For this reason, the Federal Reserve states that a CBDC would need to safeguard an individual’s privacy while deterring criminal activity.

This intersection between consumer privacy and the transparency needed to monitor criminal activity gets to the heart of the Order. On one hand, a United States CBDC would provide certain data security and privacy protections for consumers under the current rules and regulations imposed on financial institutions. The Gramm-Leach-Bliley Act (GLBA), for example, includes privacy and data security provisions that regulate the collection, use, protection, and disclosure of nonpublic personal information by financial institutions (15 U.S.C.A. §§ 6801 to 6809). But on the other hand, the CBDC would likely require the Federal Reserve, or entrusted intermediaries, to monitor and verify the identity of users to reduce the likelihood of illicit transactions.

It is unclear whether current rules and regulations would apply if the CBDC utilizes distributed ledger technology, given that they typically establish scope via definitions of applicable entities using particular data. Because users (and not financial institutions) hold copies of the data ledger under distributed ledger technology systems, pre-existing privacy laws may fail to cover large amounts of data processing and provide adequate safeguards to consumers. In addition, as the next section suggests, it is unclear how monitoring and verification would occur under a CBDC that uses distributed ledger technology. This raises further questions in how policymakers can navigate the intersection of privacy and transaction monitoring.

Privacy Implications of Distributed Ledger Technologies

Distributed ledger technologies often attempt to create an environment where users do not have to reveal their personal information. Transactions under these systems typically do not filter through a singular entity such as the Federal Reserve, but instead happen on a peer-to-peer level, with users directly exchanging digital assets without third-party oversight. In this environment, users can complete transactions utilizing hashed identifiers rather than their own information, and these transactions usually occur without the supervision of a private or government entity. Together, the use of hashed identifiers and lack of supervision creates a digital environment ripe with identity-shielding protections.

However, experts recognize that distributed ledger technologies also create a multitude of financial risks. If users can conduct transactions on a peer-to-peer level without supervision or revealing their identity, they can more easily conduct illicit activities, including money laundering, terror funding, and human and drug trafficking.

The Order acknowledges these benefits and risks. The Fact Sheet prioritizes privacy protections and efforts to combat criminal activities, which indicates that the Order seeks to emphasize the privacy-preserving aspects of new distributed ledger technologies while finding ways to restrict illicit financial activity. Such an emphasis may represent an enhanced governmental effort to address criminal activities in the digital asset landscape while avoiding measures that would create risks to privacy and data protection.

3. Future Action: Privacy and Law Enforcement Equities

The Order’s repeated emphasis on privacy seems to align with the Biden Administration’s current focus on prioritizing privacy and data protection rulemaking. The Order acknowledges both necessary safeguards to combat illicit activities and the need to embed privacy protections in the regulation of digital assets.

The U.S. Department of the Treasury and the Federal Reserve have articulated concerns regarding how bad actors exploit distributed ledger technologies for illicit purposes, and those agencies will likely make recommendations to strengthen government oversight and supervision capabilities. However, the Order’s emphasis on privacy seems to indicate that the Administration wants to ensure privacy protections while also enabling traceability to monitor users, verify identities, and investigate illicit activities.

The question is, will the Administration find a way to preserve the privacy protections of centralized and distributed ledger technology, while also promoting the efficacy of monitoring illicit activities? That answer will likely come once agencies and regulators start providing reports that recommend steps to achieve the Order’s goals. Until then, the answer remains unknown, and entities utilizing cryptocurrencies or other digital assets should stay aware of a possible shift in how the Federal Government regulates the digital asset landscape.