FPF Releases Infographic to Explore Implications of Open Banking Data Flows and Security for Individuals

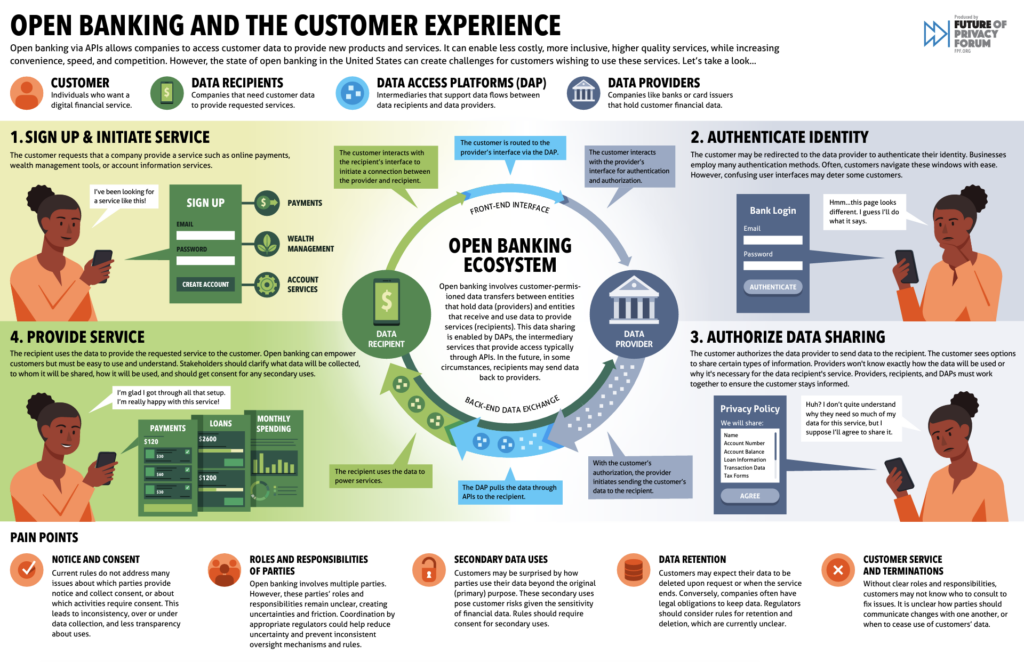

Today, the Future of Privacy Forum (FPF), a global non-profit focused on privacy and data protection, is pleased to release an infographic, “Open Banking And The Customer Experience,” visualizing the US open banking ecosystem. FPF’s open banking infographic is supported by over a year of meetings and outreach with leaders in banking, credit management, financial data aggregators, and solution providers to comprehensively understand the developing industry of open banking.

Open banking involves customer-permissioned data transfers between organizations holding data and entities that provide financial products and services (e.g., wealth management, payments, and loan access). Open banking is organized around four main steps, including (i) signing up and initiating a service; (ii) authenticating identity; (iii) authorizing data sharing; and (iv) provision of the product or service.

Open banking can be a catalyst for greater competition by enabling new products and services that depend on the sharing of personal data. While the sharing of personal data is integral to realizing these benefits, it is not without privacy and security risks, including the risk of data breaches and unauthorized transactions. The US open banking ecosystem can also be confusing for customers wishing to use these products and services as well as the organizations that provide them, including in areas related to:

- Parties’ roles and responsibilities: Open banking involves multiple parties, each with overlapping roles and responsibilities, creating uncertainties and friction for users. Coordination by appropriate regulators could prevent inconsistent oversight mechanisms and rules.

- Notice and consent: Current rules are unclear about which activities in open banking require consent, and from whom. This may lead to inconsistency in data collection and less transparency about uses of personal data.

- Secondary data uses: While companies may want to use customer data for purposes other than providing the requested product or service, misuse of financial data can cause harm, including financial loss, loss of account access, and disparate impact. To give customers greater understanding and control over the secondary use of their personal data, companies could be required to segregate secondary use consents from the primary use opt-in.

- Data retention: Individuals seeking to have their data deleted by an organization may not understand why they are unable to do so. Greater transparency and clarity is required for organizations in the open banking ecosystem that are subject to legal requirements about retaining user information.

- Customer service and terminations: Without clear roles and responsibilities, people engaged in open banking may not know who to consult to fix issues they encounter. Rules can help to clarify how parties should communicate changes with one another, or when to cease use of personal data.

The Consumer Financial Protection Bureau (CFPB) sought comments this year regarding data portability for financial products and services, which is a prerequisite to issuing a proposed rule later in 2023 to update Section 1033 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Subject to rules created by the CFPB, Section 1033 requires covered entities to make certain information related to a person’s requested products and services available to the person upon request.

In response to the CFPB request regarding data portability for financial products and services, FPF submitted comments in January 2023, which address the main pain points raised in this infographic in greater detail. FPF has also released a paper, Data Portability in Open Banking: Privacy and Other Cross-Cutting Issues, detailing how different jurisdictions’ laws impacted open banking activities and intersected with data protection law, including issues surrounding consent, security, and data subject portability rights. The paper provided grounds for discussion at an event FPF organized in 2022 with the Organization for Economic Co-Operation and Development (OECD). In February 2023, the OECD issued a paper of the same name about the event.

If you wish to speak with FPF about this infographic or would like to learn more about the organization’s Open Banking Working Group, please reach out to Zoe Strickland ([email protected]) and Daniel Berrick ([email protected]). For media inquiries, please reach out to [email protected].

This infographic would not have been made possible without the work of Hunter Dorwart, former FPF Policy Counsel, who devoted significant hours to this project during his time at FPF.